Your future starts here.

Whether you’re opening your first personal savings account or adding to a long-term savings plan such as an IRA, The Community State Bank will help you safely save money for your goals—and your future.

Our accounts make it simple for you to choose the opening deposit and minimum balance requirements that are right for you.

SAvings

A Traditional Savings Account is still a great way to meet your financial goals. The convenience, flexibility, and liquidity of this account attracts a diverse population of customers.

- Minimum Deposit to Open - $100.00

- Interest Bearing

- Quarterly Statement

- Online Banking

- ATM Card

- No Monthly Service Charge

Withdrawals limited to 6 per calendar month, thereafter $1.00 per transaction.

On Teen Ownership Accounts the following exclusions apply: No Payable on Death (POD) Beneficiary may be named and No Authorized Signer. The minor may open an account with a signed indemnigication agreement from an adult.

Youth Savings (UTMA)

Teach kids the value of saving early on, so they are prepared later in life. Managing money is not easy but it is important, and there is no better time to start than right now!

- Minimum Deposit to Open - $10.00

- Interest Bearing

- Quarterly Statement

- No Monthly Service Charge

Withdrawals limited to 6 per calendar month, thereafter $1.00 per transaction.

After the minor reaches the age of 18, it is the custodian's responsibility to distribute the funds to the minor by closing the UTMA account. The minor and custodian must both be present. The custodian will need to sign a withdrawal slip to close the account, and an official check will be made payable to the minor.

Money Market

Money Market accounts are ideal for people who want to earn market rates on a limited demand account, while keeping the money fully liquid and accessible.

- Minimum Deposit to Open - $2,500.00

- Interest Bearing

- Monthly Statement

- Online Banking

- Debit Card

- Monthly Service Charge $10 if balance falls below $2500.00

Withdrawals limited to 6 per calendar month, thereafter $1.00 per transaction.

Health Savings

A Health Savings Account (HSA) is established exclusively for the purpose of paying qualified medical expenses for the account beneficiary, spouse, and children who is covered under a high-deductible health plan (HDHP).

- Minimum Deposit to Open - $150.00

- Interest Bearing

- Monthly Statement

- Debit Card

- Online Banking

- Monthly Service Charge $2.00

Business owners may receive a tax break for contributions they make to an employee's Health Savings Account. Consult your tax advisor.

Christmas Club

The holiday season can be an expensive time of year. With that in mind, TCSB offers a special Christmas Club Account. This account is designed for customers to make minimal deposits throughout the year to save for holiday expenses.

- Minimum Deposit to Open- $0.00

- Interest Bearing

- Annual Statement

- Online Banking

- No Monthly Service Charge

- Withdrawals not permitted

- Balance plus interest paid in November

* "Save the Change" program is not available with this account.

Certificate of DEposit

The flexibility and guaranteed interest rate offered by Certificates of Deposit (CDs) makes them a popular choice for anyone wanting to maximize their return. TCSB offers a variety of terms and rates on our CDs to meet your investment needs. Our staff is well trained to help you achieve the outcome you are looking for.

- Minimum Deposit - $1,000

- Terms from 30 days to 18 months

- Fixed rates

- Interest paid monthly, quarterly, or at maturity

- Interest paid by adding back to CD, deposit, or by check

- Renews automatically

There is a penalty for early withdrawal.

Individual REtirement Account

Save for retirement now so you can enjoy your golden years in style. Enjoying a carefree retirement requires planning, and it begins by working with the right financial partner. At TCSB we make it easier to reach your long–term financial goals with either a Traditional or ROTH IRA.

A Traditional IRA allows you to defer taxes on the earnings on your contributions until they are withdrawn.

The ROTH IRA gives retirement savers a different incentive- nontaxable distributions. Regular ROTH IRA contributions are not tax deductible, so owners will not pay federal taxes on distributions of these contributions.

- Minimum Deposit - $1000

- Interest compounded quarterly

- Interest paid quarterly

- Renews automatically

Early withdrawals are subject to IRS penalties if before 59 1/2.

SAve the Change

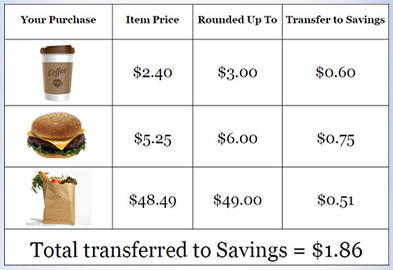

Enroll in the Save the Change program and watch your savings grow! Rounding up the purchases you make with your TCSB debit card is an easy way to ramp up your savings.

Example:

FDIC Insurance coverage:

$250,000.00 per depositor, per insured bank. This includes principal and accrued interest up to a total of $250,000.00.

$250,000.00 per depositor, per insured bank. This includes principal and accrued interest up to a total of $250,000.00.